The Illusion of Trustlessness

When Satoshi Nakamoto introduced Bitcoin in 2008, the breakthrough seemed revolutionary: computers could agree on transaction records without trusting a central authority. This mechanism, called consensus, solved the double-spend problem and launched the blockchain revolution. For over a decade, the industry has celebrated this achievement as the foundation of “trustless” systems.

But there’s a fundamental problem with this narrative: consensus only solves one specific trust problem—agreement on transaction ordering. It doesn’t solve most of the trust challenges that matter in real-world applications. Even if all computers agree that a transaction or contract ran correctly, problems can still exist. A smart contract might follow its code perfectly but still contain a bug that allows attackers to steal funds. Or the blockchain may accept false data from an external source, even though everyone agrees on it.

Consensus ensures agreement. It does not ensure trust.

This analysis explores five critical trust gaps that consensus mechanisms cannot fill: data input accuracy, code execution correctness, governance legitimacy, economic security assumptions, and practical decentralization.

Understanding Consensus: What It Does and Doesn’t Guarantee

Consensus algorithms like Proof of Work (PoW) and Proof of Stake (PoS) represent genuine breakthroughs in computer science. They solve the Byzantine Generals Problem, allowing independent participants to agree on a shared state without central authority. Bitcoin proved this works at global scale—thousands of nodes independently verify transactions while maintaining an identical ledger.

However, problems arise when consensus is treated as a universal solution. Consensus only confirms that nodes agree on transaction validity according to protocol rules. It cannot address deeper trust questions:

- Real-world data trust: Consensus verifies transactions are correctly formatted, but cannot verify whether external data is true

- Smart contract correctness: Consensus ensures contracts execute deterministically, but cannot guarantee the logic is safe or bug-free

- Governance legitimacy: Consensus can count votes but cannot determine which decisions serve the community’s interests

- Security under extreme conditions: Consensus assumes certain economic conditions hold but cannot guarantee security during state-level attacks or economic crises

When blockchain systems are described as “trustless,” this claim usually applies only to transaction ordering. Many other trust assumptions—data accuracy, governance fairness, validator behavior, contract safety—are systematically ignored.

1. The Oracle Problem

Blockchains Are Closed Systems

The oracle problem represents the clearest limitation of blockchain systems. Blockchains excel at tracking internal state—wallet balances, token ownership, contract variables. However, blockchains have no native access to external information. They cannot know asset prices, flight delays, weather conditions, or sensor readings. To interact with real-world events, smart contracts must rely on external data providers called oracles, creating a fundamental trust gap.

Consider a flight insurance smart contract that pays out when flights are delayed. The contract logic is deterministic, but it cannot observe the real world. It must rely on an oracle to report whether the flight was delayed. If the contract relies on the airline’s API, we reintroduce a single point of failure. The API could be wrong, compromised, or intentionally misleading. The blockchain will execute correctly—based on incorrect input. Using multiple data providers with majority voting appears safer but may offer only an illusion of decentralization.

The trust gap: Consensus guarantees on-chain data cannot be altered after recording. It doesn’t guarantee the data was accurate when it entered the blockchain.

Current Solutions Fall Short

The blockchain ecosystem has developed several approaches, but none eliminate the trust gap:

Decentralized Oracle Networks like Chainlink use multiple independent nodes that fetch data from various sources, stake collateral, and discard outliers. This improves resilience but relies on economic incentives and social trust, not cryptographic truth.

Hardware Oracles use IoT devices with secure enclaves that cryptographically sign sensor data. While signatures prove data came from a specific device, they don’t guarantee it reflects reality. Hardware can be manipulated while producing valid signatures.

Multi-Signature Verification requires multiple independent parties to attest to events. This distributes trust but reintroduces human coordination and social trust.

The oracle problem becomes far more serious with physical systems. Consider a smart contract releasing payment when temperature-sensitive vaccines arrive with proof of maintained cold-chain conditions. This requires trusting temperature sensors, GPS data, timestamps, data transmission, and facility confirmations. A single failure—hacked sensor, compromised GPS, bribed manager—produces bad outcomes regardless of perfect consensus.

2. Smart Contract Correctness

When Consensus Approves Disaster

If oracles show consensus cannot guarantee accurate inputs, smart contract vulnerabilities show it cannot guarantee correct execution. The 2016 DAO hack remains the defining example: ~$150M raised, ~$60M drained through a reentrancy vulnerability, all transactions valid and protocol-compliant, every Ethereum node in agreement. The network reached perfect agreement on the wrong result.

This revealed a systemic issue, not an anomaly. From 2017-2019, the Parity Wallet bug froze ~$300M and integer overflows created tokens from nothing. The 2020-2021 DeFi exploit wave saw flash-loan oracle manipulation hit bZx, Harvest, and Cream with losses from $1M-$130M. In 2022’s bridge collapse era, Ronin ($625M), Wormhole ($325M), and Nomad ($200M) saw total losses exceed $2B. Modern threats include MEV sandwich attacks, liquidity manipulation, and governance attacks.

The Trust Transfer to Auditors

Smart contract failures shifted blockchain trust from “trust in code” to “trust in security processes.” Users must now trust that auditors are competent (many audits miss critical flaws), developers implement fixes (findings are sometimes ignored), audits are comprehensive (they only detect known patterns), code hasn’t changed post-audit, and composability risks are understood. Audits certify known safety at a moment in time—not correctness forever.

The irony of “code is law” became clear: the DAO attacker followed the code exactly but violated its intent. Ethereum ultimately hard-forked to reverse the outcome. “Code is law” quietly became: Trust auditors to review the law, trust developers to write it correctly, trust we found all the bugs, and trust social consensus to intervene if everything breaks.

3. Governance and Social Consensus

The Governance Paradox

Every blockchain faces a paradox: it must remain fixed enough to be trustworthy, yet flexible enough to evolve. This requires governance—human decision-making about the protocol’s future. Consensus mechanisms excel at execution but cannot answer the most important questions: What decision should be made? Who should have authority? Which values should guide evolution?

The Bitcoin Block Size War (2015-2017) illustrated this perfectly. Small blockers wanted to preserve decentralization with 1MB blocks and second-layer solutions. Big blockers wanted larger blocks for on-chain scaling. Both had valid arguments. The consensus mechanism showed which chain had more hash power—but couldn’t resolve what Bitcoin should be. Result: Bitcoin Cash forked in 2017, the community fractured, and years of effort were duplicated.

The DAO Hack and Ethereum Fork (2016) presented a moral dilemma. “Code Is Law” said the attacker followed the contract exactly. But the exploit violated social expectations. Ethereum hard forked to reverse the hack while a minority continued as Ethereum Classic, prioritizing immutability. The community had to trust either immutability or collective moral judgment—trust beyond consensus was unavoidable.

Modern Governance Models

On-Chain Voting gives token holders voting power proportional to tokens held (MakerDAO, Compound, Uniswap). This requires trusting that large holders act in long-term interest, voters are informed, votes can’t be bought, and delegation doesn’t become oligarchy. Reality: participation typically under 10%, power concentrates among whales—formally decentralized but practically plutocratic.

Off-Chain Coordination relies on small groups of core developers proposing changes (Bitcoin Core, Ethereum Foundation). This requires trusting developers are competent, prioritize protocol health, and accurately represent sentiment. It’s efficient but concentrates power in technical elites.

Every governance model requires trust: token voting requires trust that wealth equals good judgment, core developers require trust in expertise, delegation requires trust in representatives. Consensus can enforce governance decisions with cryptographic certainty—but cannot make those decisions legitimate or wise.

4. Economic Security Assumptions

Both Proof of Work and Proof of Stake rely on economic rationality driving honest behavior. This assumption has worked well—Bitcoin has operated securely for over 15 years. But economic security is not cryptographic certainty. It rests on three hidden trust assumptions:

- Incentive Structures Are Correctly Designed: Protocol designers must anticipate all game-theoretic strategies. Failures include selfish mining (miners profiting by withholding blocks), MEV (validators extracting hundreds of millions through front-running), and nothing-at-stake problems in early PoS designs.

- Validators Act Rationally: Even perfect incentives assume economic self-interest. Reality includes irrational actors attacking out of spite, state actors acting for political reasons, and coordination risks where rational actors collude.

- Economic Assumptions Remain Valid: PoW security depends on electricity staying expensive and hardware staying specialized. PoS security depends on tokens retaining value and locked capital having opportunity cost. If token value collapses, validators have nothing to lose.

The 51% attack threshold relies on belief that acquiring 51% control is prohibitively expensive (tens of billions for Bitcoin or Ethereum). This deters most attackers—but not necessarily nation-states. This is economic deterrence, not cryptographic impossibility.

5. Centralization in Practice

Concentration of Control

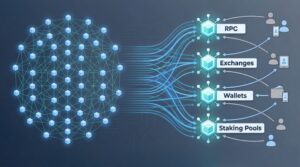

Bitcoin mining: Top 4 pools control over 60% of hash rate, with Foundry USA alone controlling ~30%. Ethereum staking: Lido controls ~29%, Coinbase ~12%, Binance ~7%. Top 5 entities control over 50%. Consensus prevents these pools from rewriting history or creating coins—but cannot prevent censorship, delay, or coordination.

Infrastructure Dependencies

RPC Providers: Most users don’t run full nodes. Infura processes hundreds of billions of requests monthly. When Infura went down in November 2020, large portions of Ethereum became inaccessible despite the blockchain functioning normally. Users must trust RPC providers to not surveil transactions, accurately report state, not censor, and maintain uptime.

Wallet Software: MetaMask has 100M+ users. Users must trust wallets generate keys securely, never leak seed phrases, and contain no backdoors. A compromised wallet update drains funds even if the blockchain remains secure.

Client Software: In 2022, Prysm controlled over 66% of Ethereum’s consensus-layer nodes. A critical bug could have halted finality. Consensus was decentralized—but the software running it was not.

Frontend Vulnerability: Even decentralized smart contracts require centralized frontends. Tornado Cash sanctions demonstrated this: the US Treasury sanctioned the protocol, the website went offline immediately, and most users lost access despite smart contracts remaining operational on-chain.

Building the Comprehensive Trust Layer

Recognizing that consensus alone is insufficient is not a failure of blockchain—it’s a moment of clarity. Consensus solves agreement, not trust. To unlock blockchain’s real potential, we must build additional trust layers that acknowledge technical, economic, and social realities rather than pretending they don’t exist.

1. Verifiable Computation and Zero-Knowledge Proofs

Zero-knowledge proofs let systems prove computations were done correctly without revealing the underlying data, replacing “trust the oracle” with “verify the math.” They power zkOracles for verifiable data, ZK-rollups for scalable execution, and zkML for provable AI predictions.This shifts trust away from institutions and toward cryptographic certainty, making computation verifiable rather than assumed.

2. Formal Verification and Secure-by-Design Languages

Formal verification proves correctness across all possible states instead of testing a few cases. Languages like Move, Michelson, and Rust prevent entire classes of bugs through strong type systems and mathematical guarantees.Trust shifts from “developers wrote good code” to “the system is provably correct.”

3. Transparent and Inclusive Governance

Governance can’t be trustless—but it can be trustworthy by design. Innovations include quadratic voting (limits plutocracy by increasing marginal vote cost), conviction voting (rewards long-term alignment), futarchy (values decided democratically, facts by markets), and delegation with accountability (recallable, transparent delegates). This reduces blind trust in leaders and replaces it with trust in process.

4. Decentralization Metrics and Accountability

You can’t manage what you don’t measure. Key metrics include Nakamoto Coefficient (collusion resistance), Gini Coefficient (wealth inequality), client diversity (software monoculture risk), geographic distribution (jurisdictional resilience), and governance participation (real decentralization signal). Mandatory Decentralization Audits with standardized disclosures make hidden trust explicit and create competitive pressure to decentralize.

Conclusion: Building Upward from Consensus

Consensus mechanisms represent one of computer science’s greatest achievements. Through elegant combinations of cryptography, game theory, they solved the seemingly impossible problem of distributed agreement without central authorities. Bitcoin’s fifteen years of operation demonstrates that consensus mechanisms work reliably at global scale.

But consensus is a foundation, not a complete system.

We conflated one specific achievement—distributed agreement on transaction ordering—with a comprehensive solution to all trust problems in digital systems. We celebrated eliminating trust from one layer while ignoring trust requirements at every other layer.

Systems claiming to be “trustless” while depending on trusting oracle data accuracy, smart contract code correctness, governance processes and decisions, economic models and incentive designs, and centralized infrastructure providers.

The Path Forward

The blockchain industry’s next phase requires intellectual honesty: acknowledging that “trustless” was always aspirational rhetoric, not technical reality. True progress comes from building comprehensive trust layers that acknowledge reality rather than deny it.

This means admitting limitations openly, measuring and disclosing trust dependencies, building trustworthy systems rather than mythologically trustless ones, and educating users honestly about what they’re trusting and why.

Consensus is brilliant. It works. It’s revolutionary. But it’s not enough. The sooner we accept this, the sooner we can build blockchain systems that deliver on their actual potential rather than their impossible promises.

The future of blockchain isn’t eliminating all trust—it’s earning trust through transparency, verification, and honest acknowledgment of where human judgment and coordination remain necessary. That’s not a failure of the technology. It’s the maturity to recognize what the technology can and cannot do.

The most trustworthy systems will be those that are honest about what they ask you to trust.

Reference:

- The Oracle Problem (Chainlink – canonical reference)

https://chain.link/education/blockchain-oracles - The DAO Hack & Governance Failure (Ethereum Foundation)

https://ethereum.org/en/history/#dao-fork - MEV & Economic Exploits (Flashbots Research)

https://www.flashbots.net - Proof of Stake Security & Incentive Assumptions (Ethereum Docs)

https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/ - Centralization & Client Diversity (Client Diversity Initiative)

https://clientdiversity.org

Know more about relevant topics:

AI-Powered Cybersecurity: The Double-Edged Sword of Modern Defense :

AI-Powered Cybersecurity: The Double-Edged Sword of Modern Defense